Table Of Content

- Lease Option Vs. Lease Purchase

- Rent-Back Agreements: Pros And Cons For Buyers And Sellers

- LSU’s Livvy Dunne Joins Passes in Company’s First NIL Deal

- Rocket Mortgage

- Column: Lauren Boebert is her own best asset — and worst enemy — as she fights to stay in Congress

- What are the pros and cons for landlords/home sellers?

- Explore the foreclosure market

Its last post, from January 2022, was a retweet of a Movement for Black Lives missive about Martin Luther King Jr. Likewise, actresses who had embraced Time’s Up’s mission offered no commentary. Jessica Chastain was tweeting about her skin care routine, while Reese Witherspoon was gushing about a Tennessee Titans draft pick. It was as though Hollywood had already moved on from the industrywide reckoning that Weinstein’s downfall sparked.

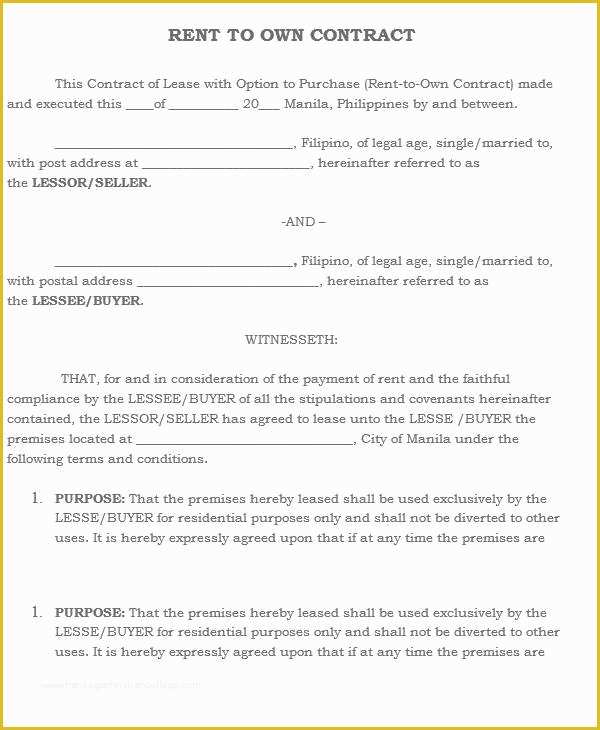

Lease Option Vs. Lease Purchase

Many agreements allow you to put your option fee— the one to five percent paid upfront— toward your home purchase. Many rent-to-own contracts also charge an additional monthly cost that is set aside to be applied to purchase your home. If you’re interested in purchasing a home through a rent-to-own agreement, it’s good to understand the process. At the beginning of your rental term, you’ll need to pay an option fee.

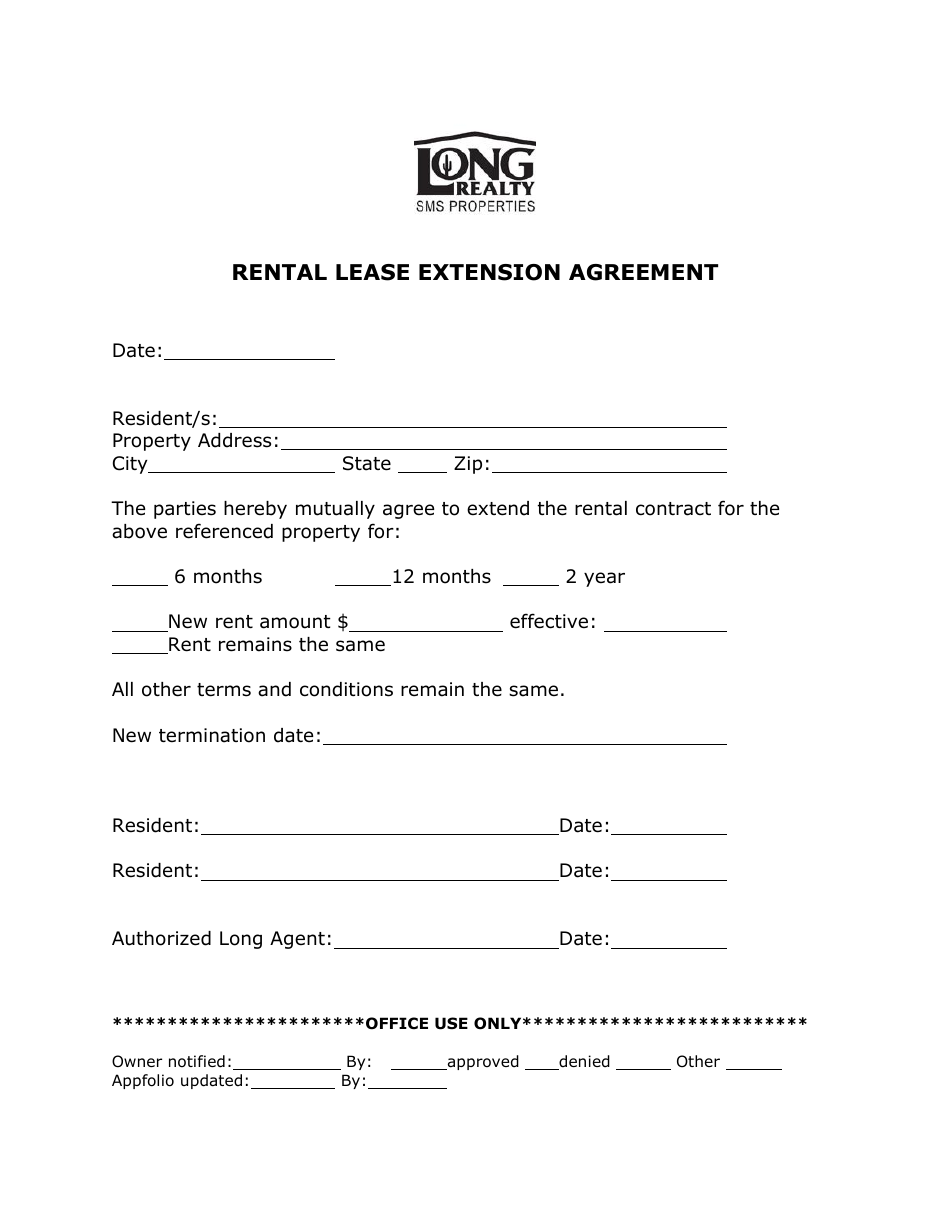

Rent-Back Agreements: Pros And Cons For Buyers And Sellers

Emotional Cleveland lease-to-own homeowners fight city in court to keep homes - News 5 Cleveland WEWS

Emotional Cleveland lease-to-own homeowners fight city in court to keep homes.

Posted: Tue, 02 Jan 2024 08:00:00 GMT [source]

If you decide not to buy the property at the end of the lease, the option simply expires, and you can walk away without any obligation to continue paying rent or to buy. Before signing the contract, carefully read the lease terms and conditions. Pay attention to details such as the rental period length, the monthly rent and any repairs or maintenance responsibilities. Knowing this upfront can help save you and the seller from headaches later on. The price may be fixed or updated based on market conditions when the agreement expires.

LSU’s Livvy Dunne Joins Passes in Company’s First NIL Deal

The last thing you want is to be putting money into a home that isn’t in the best condition just in time for you to become the owner and take full responsibility of the property. Performing a simple search online can help you find local rent-to-own programs that are specific to your area or you can even find national or regional programs. Once you’ve properly researched these programs, you’ll have enough knowledge to select which one fits your needs and can best help you eventually become a homeowner. Checking the local real estate market on a regular basis is a simple way to keep your eye on unique properties that might be ideal for this type of arrangement.

Rocket Mortgage

Game with Khaby Lame – TikTok sensation Khaby Lame invites you to his hometown of Milan, Italy for an epic, overnight gaming experience. You’ll stay in a one-of-a-kind gaming loft that Khaby designed himself, where you’ll #learnfromkhaby and face off with him in a Fortnite Battle Royale. She cited the personal shambles as the reason she switched districts, moving from western to eastern Colorado. Meantime, Atlanta-headquartered Landmark Properties broke ground on its first build-to-rent developments last year. The long-time builder and manager of student assets, Landmark did not have to be sold on the South. Its new BTR efforts are The Everstead at Conroe, a 190-unit community in suburban Houston, Texas, and The Everstead at Madison, a 231-unit development in the Huntsville, Ala. area town of Madison, Ala.

Column: Lauren Boebert is her own best asset — and worst enemy — as she fights to stay in Congress

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. It’s common to live in your home once you purchase it for at least three years, or for however long it takes to build up enough equity so that when you sell your home, you either have broken even or made money. If your contract is a lease-purchase agreement, you’ll likely have fewer options. The options available to you depend on the contract, which is why it’s so important to have it reviewed by your attorney. A lease-purchase agreement typically states that you have to purchase the property at the end of the contract, whether or not you still want the property or can secure funding (i.e. a mortgage).

Pros Of Rent-To-Own Homes

At that point you can finance the purchase by getting a mortgage, just like any other homebuyer. A rent-to-own home is an agreement that allows the renter to buy the home from the landlord after a specific lease period. With a rent-to-own contract, you’ll have to pay a lease option fee upfront. This is essentially a security deposit that ensures your right to purchase the property at the end of the lease. In some cases, this fee will be applied to the down payment at the end of the lease term. Typically, both your monthly rent payments and payments toward your purchase of the home, if any, will be outlined in your rent-to-own agreement.

If they’re interested in selling the property they’re currently renting out, your rent-to-own offer could be a great way to make that transition. Even if a seller isn’t currently offering a rent-to-own option, your agent can float them the possibility. As with any home purchase, there are many ways to find what you’re looking for. We’re explaining the several different ways you can find rent-to-own homes.

When you buy through a rent-to-own agreement, you’ll typically either be buying from an individual home seller (sometimes an individual real estate investor) or through a real estate investment company. Luckily, rent-to-own homes are just one way to go when buying a home for the first time, but it’s not for everyone. We’ll take you through some of the important details you might consider while you decide whether rent-to-own is the best option for your home buying goals. If you have a lease-purchase contract, you may be legally obligated to buy the property when the lease expires. This can be problematic for many reasons, especially if you aren’t able to secure a mortgage.

Morgan Wealth Management Branch or check out our latest online investing offers, promotions, and coupons. Check out the Chase Auto Education Center to get car guidance from a trusted source. From basic definitions to little known downsides, we’ve got you covered. Live in your dream home today, and a portion of your monthly Divvy payments grow into a down payment over 3 years—so you can buy your home. Rebecca, a freelance editor for LendingTree, is a marketing and content specialist who has worked in the personal finance space since 2017. A graduate of Millersville University of Pennsylvania, she received a degree in English with a minor in journalism.

For more information on available products and services, and to discuss your options, please contact a Chase Home Lending Advisor. A preapproval is based on a review of income and asset information you provide, your credit report and an automated underwriting system review. The issuance of a preapproval letter is not a loan commitment or a guarantee for loan approval.

Making an offer to a property owner could get you into a rent-to-own agreement that positively benefits both you and them. As we mentioned earlier, properties that are in preforeclosure or have been sitting on the market for a long time could be ideal candidates for a type of rent-to-own agreement. But, before you enter into this unique real estate agreement, you’ll need to search for a rent-to-own property. Let’s discuss the different ways you can go about finding this kind of home. You can start by contacting sellers directly if their home has been on the market for at least three months. Make sure you review a rent-to-own contract example if you go down this road so you understand what you’ll be negotiating.

The seller of the home allows you to rent the home with the option to buy it at a later date and count your rent toward a down payment. However, before you sign a lease-purchase agreement, make sure you understand how it works and the risks involved. Renting to own can be an appealing concept for people who are interested in owning property but have thus far been shut out of the traditional homebuying process.

No comments:

Post a Comment